iPod : "Designed by Apple in California, Made in China."

To be precise, iPod is designed in Cal., it's components are manufactured in Asia, then iPod is assembled in China and is being sold globally.

During my visit to US in March 05, I attended New York Times' columnist Thomas L. Friedman's lecture on his new book -- "The World Is Flat: A Brief History of the Twenty-first Century" (published on 5 April).

He outlined his new book in his lecture, and I chatted with him briefly after the lecture. His book is about "Outsourcing" and "Globalization".

Chatted with audiences and people I met over the trip, I found

Friedman is an excellent speaker, respond from audience was great. I found the talk interesting too, but I was not as "surprised" and "shocked" as other US audience.

Friedman uses the "The World is Flat" as a metaphor for the fact that "the global playing field is being leveled". The book is about how the convergence of technology and events that allowed India, China, and so many other countries to become part of the global supply chain for services and manufacturing, creating an explosion of wealth in the middle classes of the world's two biggest nations, giving them a huge new stake in the success of globalization.

"Well, what is so new about this ?" I thought.

Perhaps, Hong Kong have located at the very front-line of globalization, we have experienced "outsourcing" for too long. Losing manufacturing jobs to workers in China have been the trend since early 1980's, losing call-center jobs to China have been the trend since early 1990's.

I joined the drink section of a group of audience after the seminar. I found there are plenty mis-conceptions on international trading relationship between US and China. The common mistake is mis-focus on US-China trade deficit figure, and forget the reality is a multi-countries trade & division of labor network.

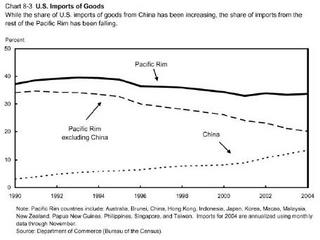

Indeed, there has been a structural change in US-China-Asia trade relationship since mid 90's.

In old days, Asia directly export to US. However, in recent years China emerged as the final assemble centre for Asia's goods (ie. triangular relationship: Asia countries(raw material/technology/components) => china(assemble/manufacture) =>US(sale & marketing).

China becomes the launching-platform of manufacture products. US import from China is mostly a substitution of US import from other Asia (including Japan and Korea) countries (Graphic Source: The Economic Report To President 2005).

Cos, advanced countries like Japan / Korea / US / European have focus on highest - valued components (e.g. design & manufacturing of semi-conductor, DRAM, LCD screen) and shifted the lowest-end manufacturing / final assemble process to their factories in China.

The name-tag "Made In China" has lost its meaning.

In fact, China's semi-finished products and raw material import have been the driver of economic growth in Asia and Latin America. Thankfully, this process (a) bring a lot of employment opportunity to developing countries, (b) pull developed Asian-countries (eg Japan, Korea) out of recession.

Moreover, US multi-national corp (MNC) have extracted huge benefit in the process. US MNC focus on the most high-value added end -- R&D on one end and Sales & Marketing on the other end -- and cut the largest slice of the profit.

For example, US consumer may be surprised by finding their Compac notebook computer is actually assembled in Shanghai, however, this doesn't change the fact that (a) US consumer enjoy the same notebook computer at lower price that otherwise, (b) the notebook is shipped by

Fedex, (c) most of the profit generated from this purchase actually go to Compac / Fedex and their shareholders.

Another example is : when US consumer buy a pair of hottest Nike shoes for $150 (or buy a pair of less fashionable Nike at $35), the factory in China only receive $1.00 per pair of shoe no matter how much the retail price is, and the $149 (or $34) go to Nike's profit, marketing firm, TV, billboard, Micheal Jordon, Walmart / other shoe-chain stores, employees and shareholders in these companies -- who are mainly US citizens. The same pair of Nike shoes also "export" to countries all over the world under the name-tag of "Made in China" and most of the profit go into Nike shareholders' pocket.

A lot of US MNC have seized the opportunity and transformed themselves into the champion of globalization -- Walmart, Nike, Starbuck, Intel, Apple, Compac, Dell, UPS, Fedex

.... etc.

Of course, there are always winner and loser in every new-mega trend – in this case, low-end manufacturing job loss in US and SE Asia countries have lost out. However, no one can reverse the trend and it is not for the benefit of anybody to do so.

Related Article : 日本與中韓台〝技術戰爭〞開打,優勢能撐幾年?

沒有留言:

發佈留言